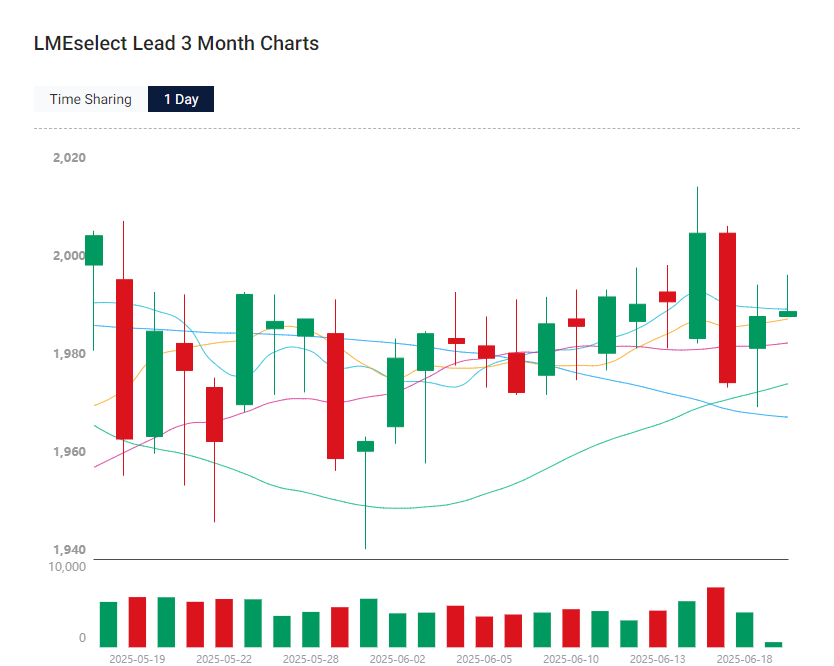

Lead prices were in the doldrums on June 18, 2025: LME lead hit a new low since June 4 this year, while the SHFE lead 2507 contract reached a new weekly low of 16,750 yuan/mt.

On June 19, lead prices rebounded and made up for previous losses. Why was the price resilience so significant?

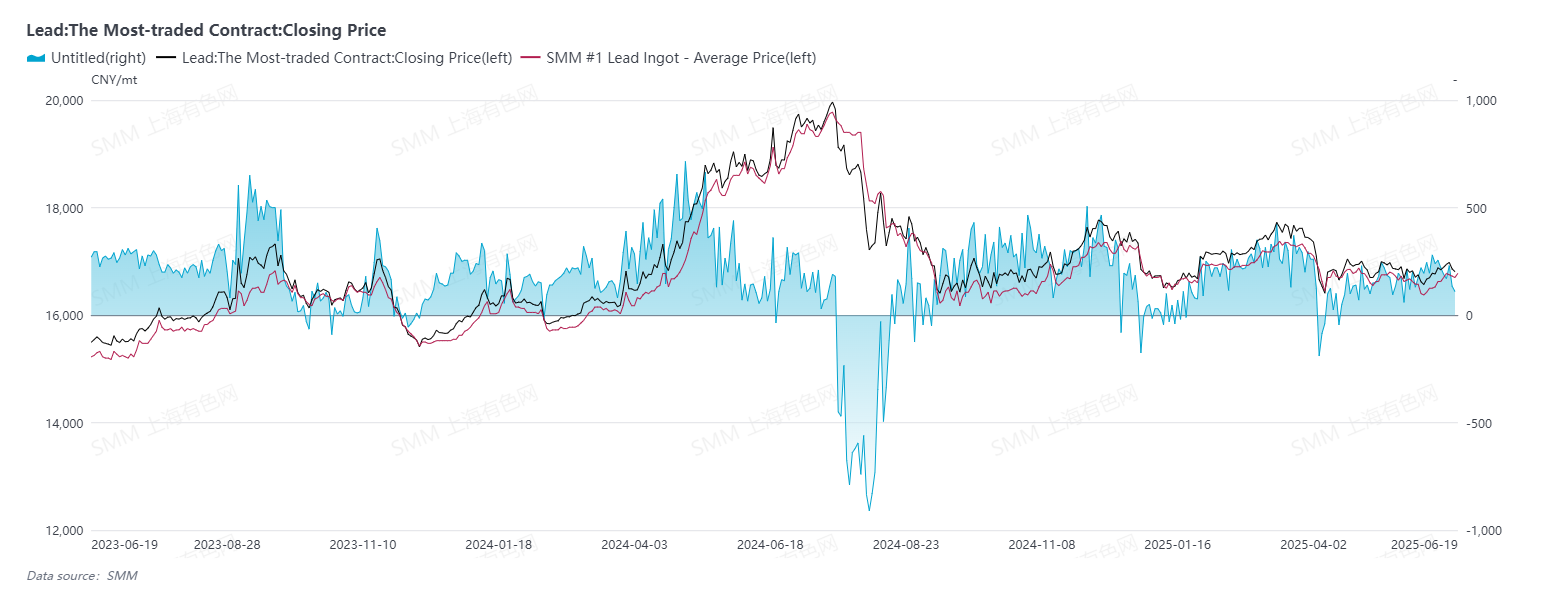

As shown in the chart below, spot market quotes have remained firm recently, with some spot orders even quoted at a premium against the SMM 1# lead average price for self pick-up, narrowing the spread between futures and spot prices.

For primary lead, apart from factors such as delivery brand premiums and the location of cargo sources, the expected supply tightening due to maintenance plans at individual smelters of delivery brands has also led suppliers to quote firm prices. In Q1, maintenance was carried out at some medium-to-large overseas lead concentrates mines, with limited recovery in Q2. As a result, domestic imported lead concentrates supplies are tight. Although domestic lead concentrates supplies are relatively stable, overall lead concentrate prices remain high, which also supports primary lead prices.

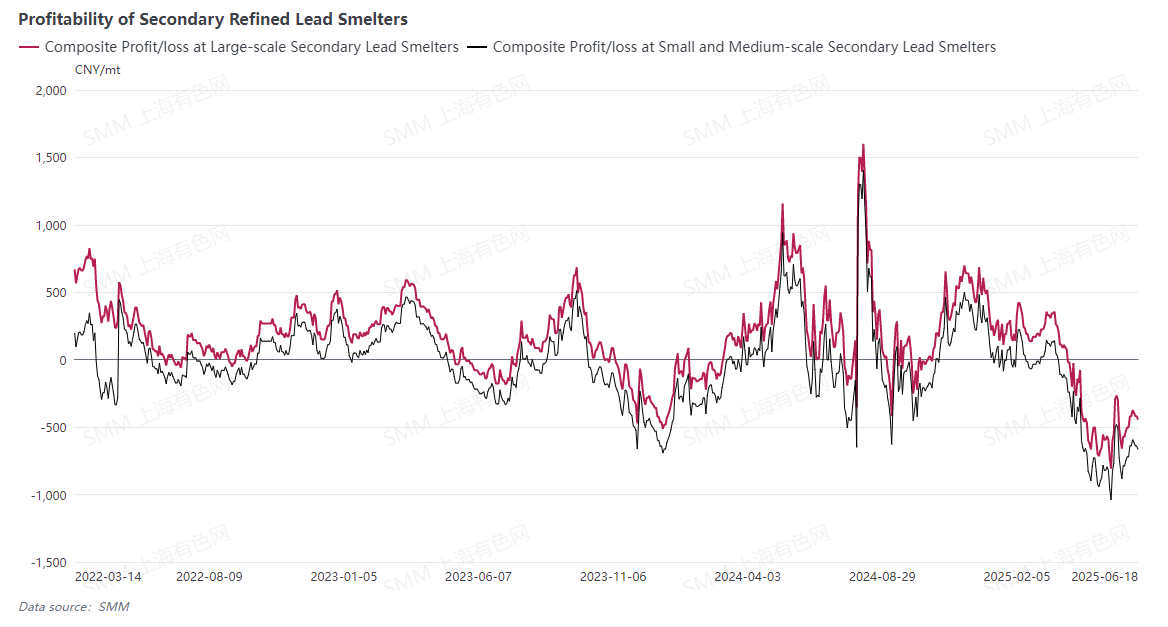

For secondary lead, raw material costs remain the main factor behind its firm quotes. The off-season for scrap and overcapacity in secondary lead production have led to an undersupply, prompting waste lead-acid battery prices to maintain an upward trend. With high raw material prices and struggling to rise in finished lead prices, secondary lead smelters are currently operating at a loss.

The combination of loss pressures and tight raw material supplies has resulted in poor production enthusiasm and low willingness to sell at secondary lead smelters, leading to a shortage of spot order cargo sources in the secondary refined lead market. In summary, the firm raw material cost prices and the expected supply tightening of primary lead have made lead prices resistant to decline.

Yesterday, the SHFE allowed overseas investors to participate in lead futures and options trading, which may increase trading activity in the lead market to a certain extent and provide some support for lead prices in the short term. However, the ultimate trading logic still needs to focus on the trend of fundamental changes.

What we need to be wary of is that global lead supplies have gradually shown a surplus trend recently, with overseas inventories once again approaching the 290,000 mt threshold. Although domestic fundamentals have improved somewhat due to production cuts and suspensions on the supply side, the impact of the traditional consumption off-season has not significantly improved, becoming the main factor dragging down lead prices.